Arola

Legal

Leading Special Tax Consultants

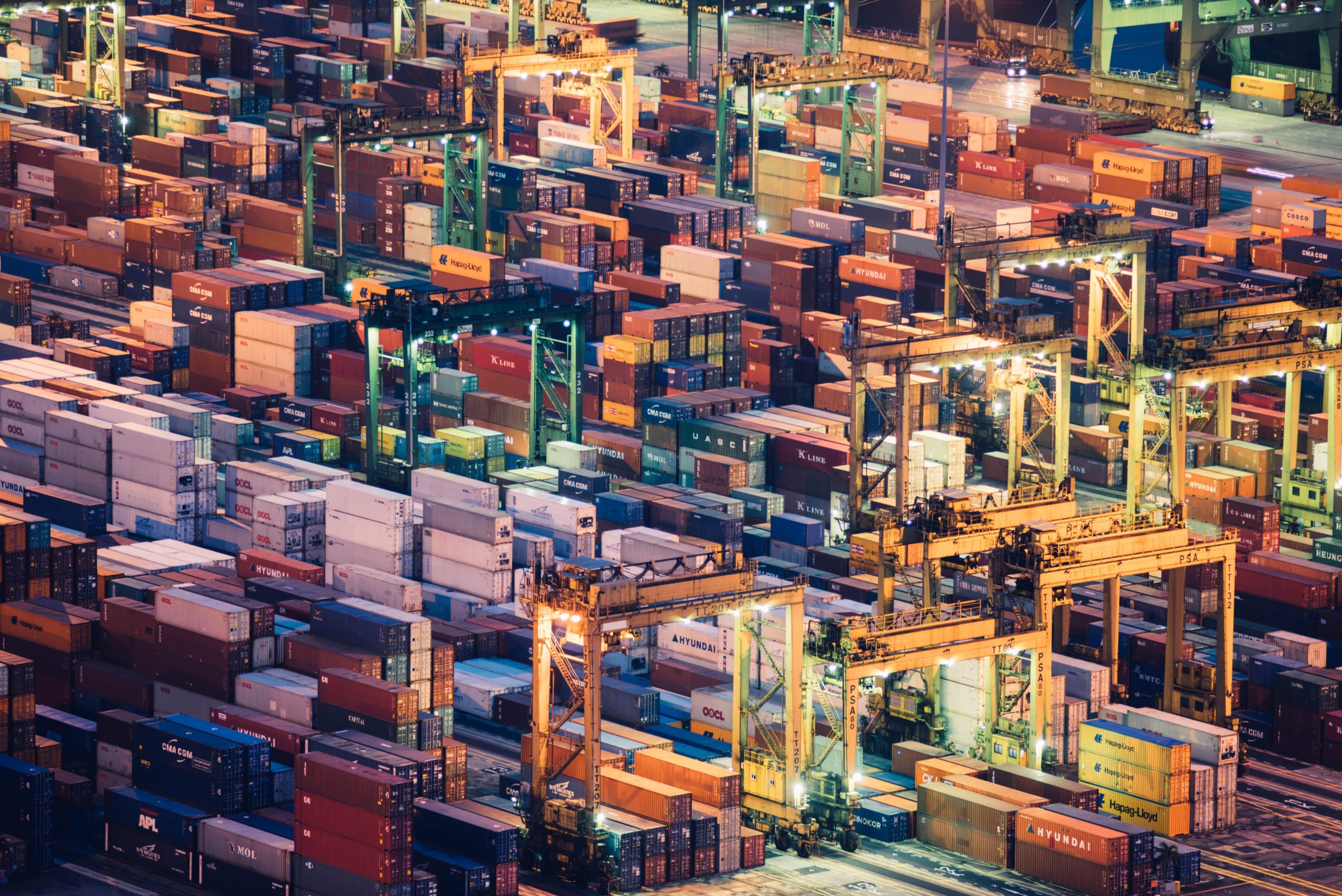

Specialists in Environmental Taxes, Customs Law and International Trade

Arola Legal is a highly specialized office dedicated to advising and defending our clients in matters of Special Taxes, the Energy Sector, Environmental Taxes, VAT in international trade, and Customs Law.

Our team of lawyers, who are fast in solving problems and experienced thanks to long careers in these matters, aim to provide you with personalized advice.

Our Services

At Arola we have one goal: to transform your business. Thanks to our experience, we can make any procedure or authorization stop being a hindrance and become one more way of generating value for your business. To do this, we have the expertise of Hitsein Abogados, who form a team of expert lawyers in customs law, international trade and special taxes.

Contentious Taxation

We have a team of experts in contentious tax matters with extensive experience in all types of procedures regarding tax authorities.

Indirect Taxation

Our team of experts offers a global consulting service, tailored to the needs of our clients in matters of special taxes, environmental taxes, VAT in international trade and customs law.

.

Energy

With extensive experience in the energy sector, we offer consulting on the proper fulfillment of all the obligations imposed by hydrocarbon, gas and electricity regulations.

Specialists in

Energy products and electricity

All the advice necessary on special taxes and sectoral regulations (CNMC, CORES, SICBIOS.)

Alcohol and Alcoholic Drinks

We cover advice on all alcoholic beverages (wine, beer, spirits) as well as alcohol for industrial use.

Other Special Taxes

Specialists in all special taxes (tobacco, carbon, registration).

Environmental Taxes

At the forefront in consulting regarding the new environmental taxes (fluorinated gases, plastic containers, waste) at both national and regional levels.

International Trade

Experts in the field of customs and VAT in international trade, with the Grupo Arola seal of prestige.

Our team

Víctor Guarch

Legal & Tax Manager

Abogado

Víctor Guarch

Legal & Tax Manager

Abogado

News

New HCP import controls

Pursuant to NI GA 09/2023 of 9 May on the import control of hazardous chemicals (HCP TARIC measure), from 1 June, customs will apply the HCP TARIC...

New AES export system

9th May, Spanish customs will implement a new automated export system (AES) to replace ECS. According to the European Commission's timetable, the...

Exports to third countries at risk of circumventing restrictive measures against the Russian Federation and Belarus

The European Union has adopted several packages of restrictive measures against the Russian Federation due to Russia's war of aggression against...

Turkey: Logistical Situation

This article analyses the logistical consequences of the devastating earthquakes that struck the southern regions of Turkey and northern Syria on 6...

Draft of the law on the tax on port emissions of the large ships to be applied in the ports of Barcelona and Tarragona

Draft of the law on the tax on port emissions of the large ships to be applied in the ports of Barcelona and Tarragona. In order to align the air...

Preferential proof of origin for EU exports to Singapore from 01/01/2023

Preferential proof of origin for EU exports to Singapore from 01/01/2023. In accordance with the Decision No. 1/2022 amending the Origin Protocol of...

Partnerships